Part 2/4

Integrated business planning is industry-speak for the close collaboration and data-sharing between key business functions such as finance and operations and there are a few reasons why it is a crucial component of business success:

- It improves planning accuracy and operational and financial performance by aligning business strategy, resource allocation, supply chain, and sales, marketing and product development functions.

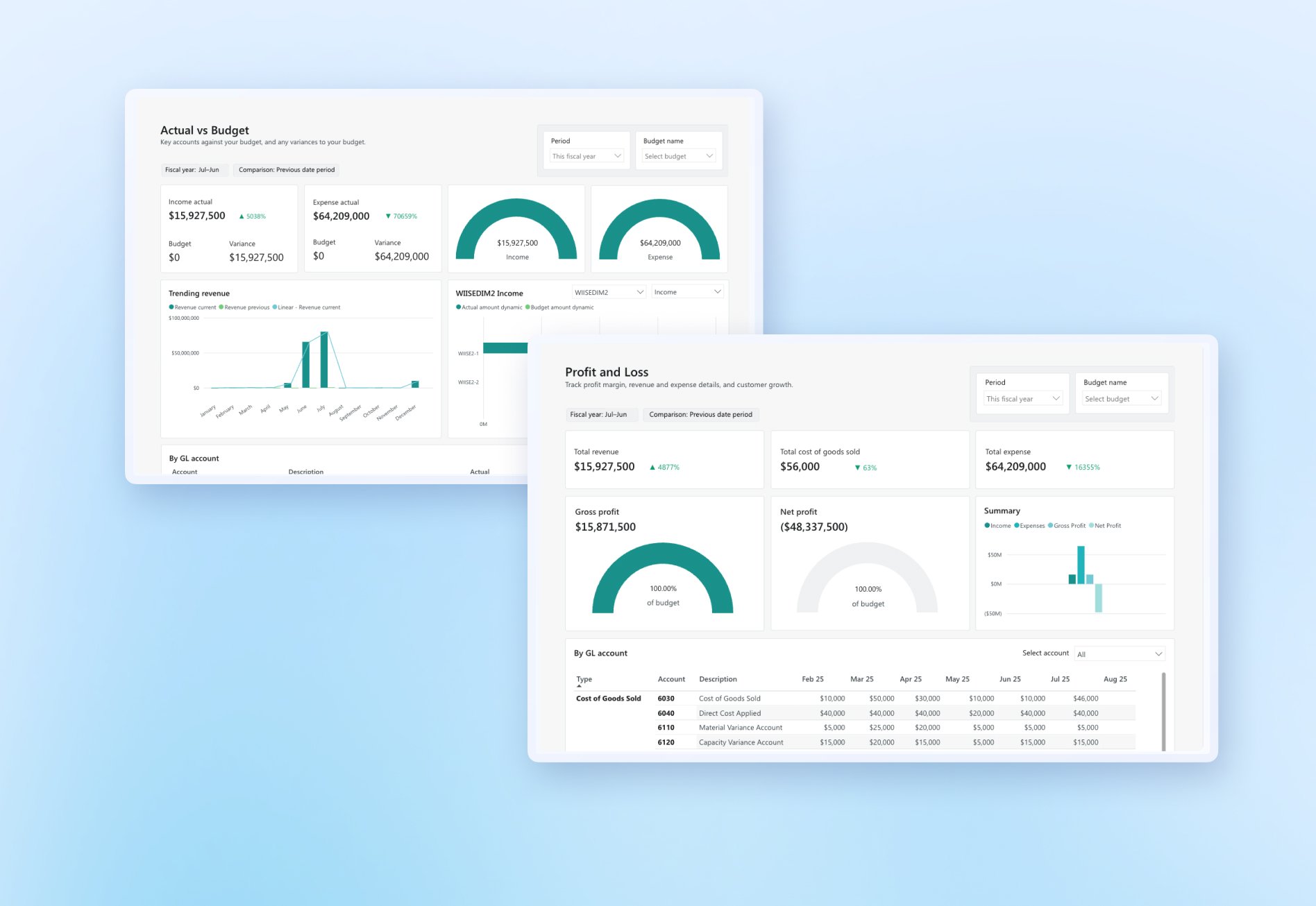

- It supports business leaders with planning and investment decisions through a dashboard of current financial and operational performance and reporting.

- It also helps to identify, at an early stage, potential financial and operational shortfalls and the impacts of key constraints.

Yet, the survey of 1,300 leaders from finance and operations finds there is insufficient inter-functional collaboration and misaligned KPIs between the two teams, and reveals that:

- Only 36% say integrated planning is a reality across the two functions.

- Just 41% were very satisfied with their use of data to support analytics or planning.

- Just 31% were very satisfied in their ability to apply advanced analytics to data.

Although these statistics are stark, the Value of Connection report is helpful in identifying something that leaders of both functions are closely aligned on — both finance and operations leaders do agree on the urgency around improving operating models by focusing on skills, technology and data.

Improving and innovating operating models is the highest priority for operations leaders over the next 18 months and is the third-most important priority for finance leaders. This means that organisations today have a very real opportunity to capitalise on a rare set of closely aligned priorities between seemingly disconnected business functions.

The overwhelming majority of leaders surveyed — 97% to be precise — recognise this and say they are investing in the tools that enable data sharing between finance and operations teams. Three compelling findings about integrated business planning in particular are noteworthy:

- 97% of finance and operations leaders plan to invest in new integrated planning tools over the next 18 months.

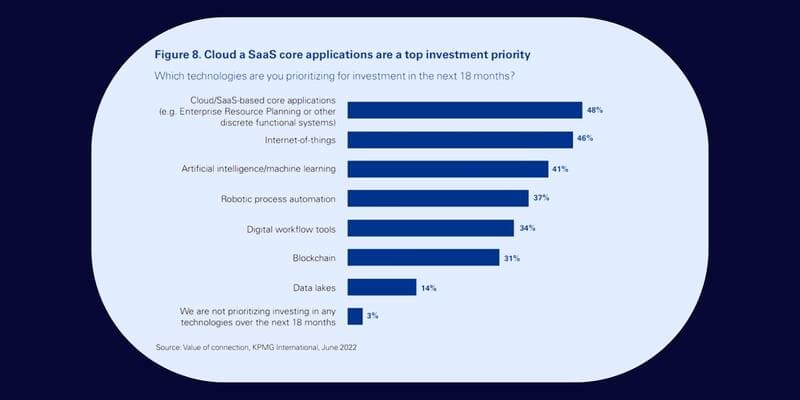

- Cloud and SaaS-based core applications such as Enterprise Resource Planning solutions are the highest investment priority for business leaders.

- Investing in Enterprise Resource Planning and other discrete functional systems is a higher investment priority than Internet-of-things, Artificial intelligence and machine learning, Robotic process automation and Blockchain.

CFO perspective

How can organisations ensure better data-sharing between finance and operations?

“There’s no quick fix. The only way to make material improvements is to move core systems and data to the cloud, which makes data much more accessible.”

-Roland Moquet, CFO at insurance company AXA UK

Summary

Organisations that successfully build on the rare alignment between finance and operations teams over technology and skills requirements by investing in cloud and SaaS-based core applications that enable integrated business planning, can minimise the value of data left on the table to be more strategic with decision-making and edge past their competition.

About the Wiise Value of Connection series

KPMG surveyed 1,300 finance and operations leaders from organisations in 16 countries across multiple sectors to quantify the impact of disconnected business functions. It published the findings in a June 2022 report titled Value of Connection, which you can download below. The report explains how deeper integration between Finance and Operations can transform customer experiences, build trust, and accelerate value creation.

With organisations in the APAC region making up 25% of this survey, the 2022 Value of Connection report has significant implications for business leaders in Australia.

Our four-part series unpacks the key takeaways from the report, which is a must-read for finance and operations leaders.

Other articles in the series

Love our content?

Our LinkedIn page has more great updates.